Editor’s note: This story is part of a series exploring emerging manufacturing hubs across the U.S. Have a manufacturing story you want told? Email us at [email protected].

In 1992, German luxury vehicle company BMW chose South Carolina as its first U.S. manufacturing location. That decision laid the groundwork for South Carolina to become the automotive manufacturing hub it is today, attracting billion-dollar investments from global EV and battery companies.

Those investments have grown even more lucrative in the wake of the Inflation Reduction Act, which incentivizes EV makers to produce vehicles and batteries in the U.S.

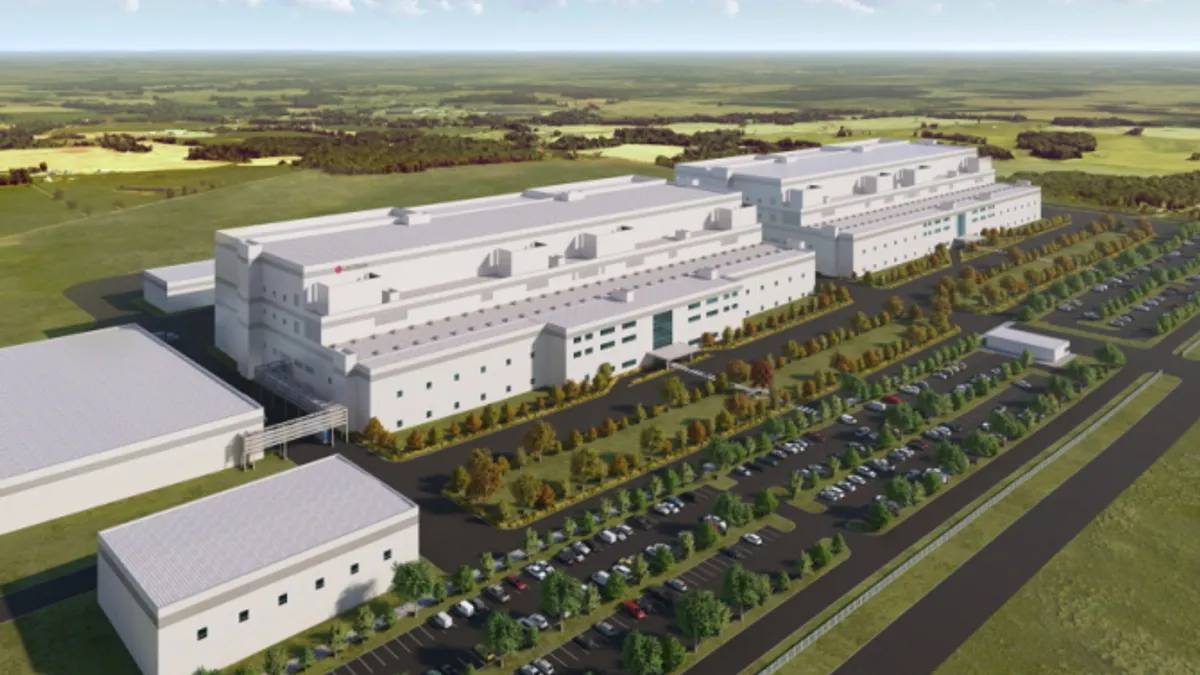

BMW’s battery supplier, Japan-based Envision AESC, announced a $810 million battery cell production facility last December in northeast South Carolina. Just a few days later, battery recycler Redwood Materials announced a $3.5 billion facility in Charleston.

And in March this year, Volkswagen-backed Scout Motors announced a $2 billion EV manufacturing plant outside Columbia, and Vietnam-based tire manufacturer Tin Thanh Group Americas announced a $68 million facility in Fairfax.

“South Carolina has grown a robust mobility ecosystem, with more than 500 automotive-related companies within the state,” said John Lummus, president and CEO of Upstate SC Alliance, an organization that offers site selection services for companies looking to set up shop in the state.

Tax and financial benefits

One of the biggest factors influencing site selection decisions is the generosity of its tax policies and financial incentives — areas in which South Carolina ranks well with businesses.

South Carolina offers aggressive statuatory tax incentives to draw companies to the state, including:

- No state property tax;

- no inventory tax;

- no sales tax on manufacturing machinery, industrial power or materials for finished products;

- no wholesale tax;

- no unitary tax on worldwide profits;

- a favorable corporate income tax structure; and

- no local income tax.

The state’s Coordinating Council for Economic Development also offers three discretionary grant funds to aid in the development of new projects, according to the South Carolina Department of Commerce.

This includes a “set-aside program,” to help fund site development and necessary infrastructure improvements, said Michelle Comerford, industrial and supply chain practice leader at Biggins Lacy Shapiro & Co. Another is the “governor’s closing fund,” designed to assist with recruiting or retaining high impact economic development projects.

“Both of these grants are very valuable to a mega project and an overall “difference maker” in the site selection decision,” Comerford said.

Multiple headline-making projects have received these types of funds. For example, Scout Motors received $1.29 billion in state incentives and up to $180 million in job development tax credits for locating its manufacturing facility in South Carolina.

In addition to traditional incentives, Governor Henry McMaster signed an executive order last October to create the SC EV Economic Development Initiative.

The order gives state policymakers more authority to expand the state’s EV manufacturing market through favorable legislation and tax policies, said Sam Moses, partner at Parker Poe, which advises auto manufacturing and technology companies on site selection.

“This brings all of the resources within the state’s government, including the South Carolina Department of Transportation, to identify and propose policies to lawmakers to enhance the state’s capabilities to serve the EV market and make the state more attractive for EV companies,” Moses said.

Many of the companies that come to South Carolina will also benefit from various federal incentives, including those that are a result of the Inflation Reduction Act, he added.

Robust workforce

While the U.S. continues to struggle with a labor crunch in the manufacturing industry, South Carolina offers a deep talent pool with knwoledge in emerging technology, said David Clayton, executive director of the Clemson University International Center for Automotive Research.

“Our state's institutions continue to make investments to complement the larger economic development strategy,” Clayton said.

For example, Clemson University recently launched a Composites Center to help firms in basic and applied research for low-cost, lightweight composite materials for the automotive sector. Clemson has also established one of the first Bachelor of Science in automotive enginering degree programs in the country.

At the state level, the South Carolina Technical College System offers customized training programs to help individuals learn the skills needed to succeed at incoming manufacturing facilities in the state.

This includes training future employees based on a company’s specific needs and purchasing the type of manufacturing equipment and machines so that workers can master the skills before joining the company, said Kelly Coakley, director of marketing and communications at the South Carolina Chamber of Commerce.

"Choosing a location that has already proven successful for other similar operations minimizes risk."

Tracey Hyatt Bosman

Managing Director, Biggins Lacy Shapiro & Co.

Favorable location

One of the biggest draws for manufacturers choosing South Carolina is the state’s proximity to other automotive and parts manufacturers.

“We have a well-established supply chain and a diverse array of suppliers who are ready for the production of electric vehicle components,” Lummus said.

This creates a reinforcing cycle, attracting even more manufacturers to the region.

“Automotive companies, including EV operations, are predisposed to seeking out existing automotive/EV clusters to take advantage of access to supply chains, workforce skillsets, and educational/research resources,” said Tracey Hyatt Bosman, managing director at Biggins Lacy Shapiro & Co. Bosman previously worked with the state’s Department of Commerce to attract automotive investment to the area.

“Choosing a location that has already proven successful for other similar operations minimizes risk,” Bosman added.

Geography

Along with proximity to manufacturing clusters, companies in the state also benefit from a favorable geographic location, with affordable resources and port access, including in Charleston and Georgetown.

“The Palmetto state has one of the few deep-water ports on the east coast and the state has continued to make strategic investments to deepen the port, allowing for larger ships to continue to serve the state,” Clayton said.

The rail and interstate infrastructure is also well-suited to support the import of supplies and export of finished goods, Clayton and Lummus noted.

“Producing batteries and electric components is power-intensive, and available, affordable utilities are a huge driver for these types of projects,” Lummus said. “Within the Palmetto state, electricity sources are diverse, with nuclear, hydroelectric, and coal sources feeding our grids.”