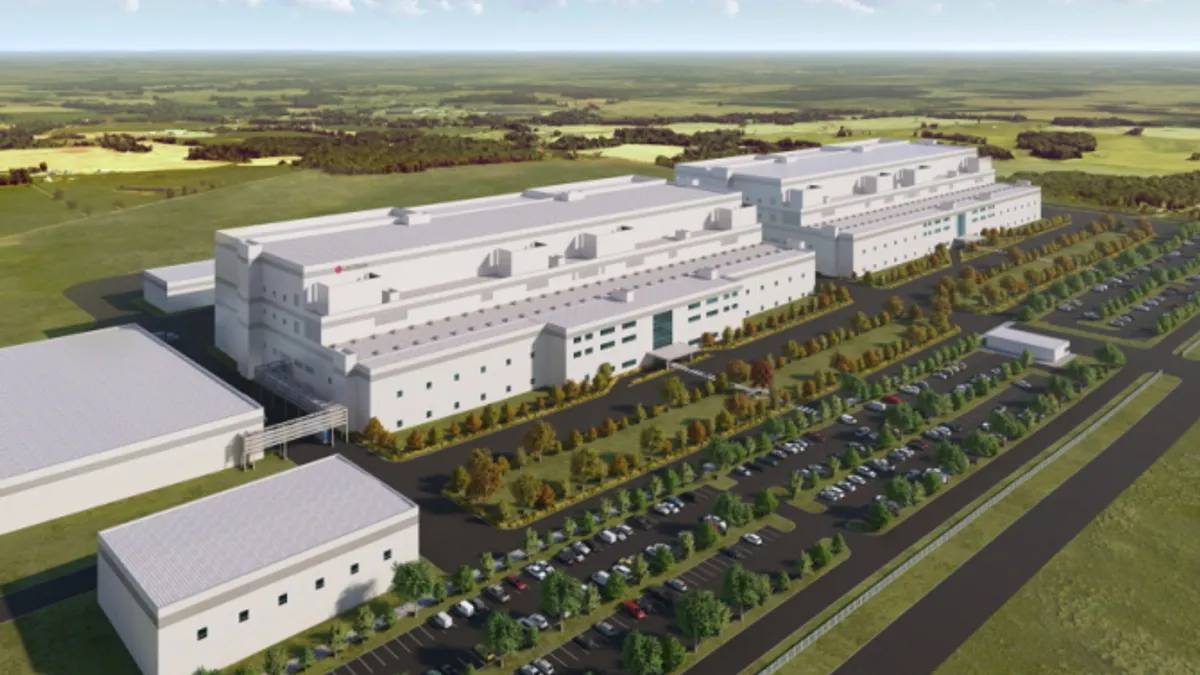

When Intel chose Licking County, Ohio as the home of a $20 billion chip manufacturing site, it didn’t do so on a whim. The technology giant is investing in one of the country’s most productive states and what CEO Pat Gelsinger called the “Silicon Heartland.”

Out of this heartland will grow two mammoth advanced semiconductor production facilities, with the largest private-sector investment in the state’s history. The project will also create 3,000 Intel jobs, 7,000 construction jobs and thousands of other roles through suppliers and partners.

“A semiconductor factory is not like other factories; Building this semiconductor mega-site is akin to building a small city, which brings forth a vibrant community of supporting services and suppliers,” Keyvan Esfarjani, Intel senior vice president of manufacturing, supply chain and operations said in a statement. “Ohio is an ideal location for Intel’s U.S. expansion because of its access to top talent, robust existing infrastructure, and long history as a manufacturing powerhouse.”

Manufacturing in Ohio is booming, producing $40.5 billion in manufactured good exports in 2020, according to the National Association of Manufacturers. The output accounted for more than 16% of the total output in the state.

There’s a reason Ohio is attracting some of the biggest manufacturing projects in the country such as Intel and Ford. It comes down to talent, cost and location, according to Matt Englehart, spokesperson for JobsOhio, the state’s private economic development corporation.

“In Ohio, we have a strong mix of affordability, quality of life, diverse industry and communities, as well as a physical location near 60% of the U.S. and Canadian marketplaces,” Englehart said.

Tax incentives entice new projects

Ohio tax incentives help with affordability for manufacturers looking to save on long-term costs.

The state government, in collaboration with JobsOhio, offers a wide range of financial incentives to attract major developers. The Ohio Job Creation Tax Credit offers refundable and performance-based tax credits for “companies creating at least 10 jobs (within three years) with a minimum annual payroll of $660,000,” according to the program’s website.

Other loan and grant programs include the 166 Direct Loan for land and building acquisition, the Innovation Ohio Loan Fund for existing state-based companies to develop new products and services and the Ohio Enterprise Bond Fund for revenue bond financing.

“The substantial manufacturing investments being made here aren’t happening by accident,” said Ryan Augsburger, president of The Ohio Manufacturers’ Association. “They are the result of years of reform to improve Ohio’s business climate — including in the areas of taxation, regulations and workforce.”

Some of the biggest benefits include the state’s tax exemption policies, which the Ohio Manufacturing Association helped develop. A prime example is the state’s manufacturing sales tax exemption, in which purchases of machinery and equipment for manufacturing activities in Ohio aren’t taxed.

A strong talent pool of recruits

Along with offering solid financial benefits, Ohio is improving its already robust workforce, giving so manufacturers a diverse talent pool to choose from. The manufacturing sector employs nearly 700,000 workers, and more than 80 campuses at 27 colleges and universities in Ohio graduate 11,700 engineers and engineer techs per year.

In August, the Ohio Manufacturing Association won a $23.5 million workforce grant from the U.S. Economic Development Administration for its Good Jobs Challenge, bringing millions of dollars in funding for manufacturing workforce development. The initiative seeks to enroll 6,000 individuals in one or more training programs that lead to a job offer or upskilling opportunity at their current employer.

“By providing Ohioans with opportunities to upskill or be trained in cutting-edge careers, we will grow Ohio’s workforce, especially in the manufacturing, broadband, and electric vehicle sectors,” Governor Mike DeWine said in a statement. ““We want to continue to help provide Ohio employers with qualified workers in order to grow their businesses, and this grant will help us do just that.”

The association also coordinates a network a local industry partnerships to help facilitate cross-collaboration between state manufacturers and solve workforce challenges.

Many states in the US offer a strong workforce, tax incentives, or collaboration opportunities, but Ohio is one of the rare few states to offer everything in one place.

And with the recent onslaught of high-profile projects headed to the state, as Augsburger said, “Ohio has always been the manufacturing state. Now the rest of the nation is finding out why.”