Editor’s note: This story is part of a series exploring emerging manufacturing hubs across the U.S. Have a manufacturing story you want told? Email us at [email protected].

Tennessee has attracted an increasing number of manufacturing investments in recent years.

Projects have been announced by companies from around the world, with billions of dollars in investment headed to the state for EV-related manufacturing facilities. Ford broke ground on a $5.6 billion EV campus in Stanton, Tennessee in September. And Bridgestone announced plans to invest $550 million to expand its tire plant in the city of Morrison that same month.

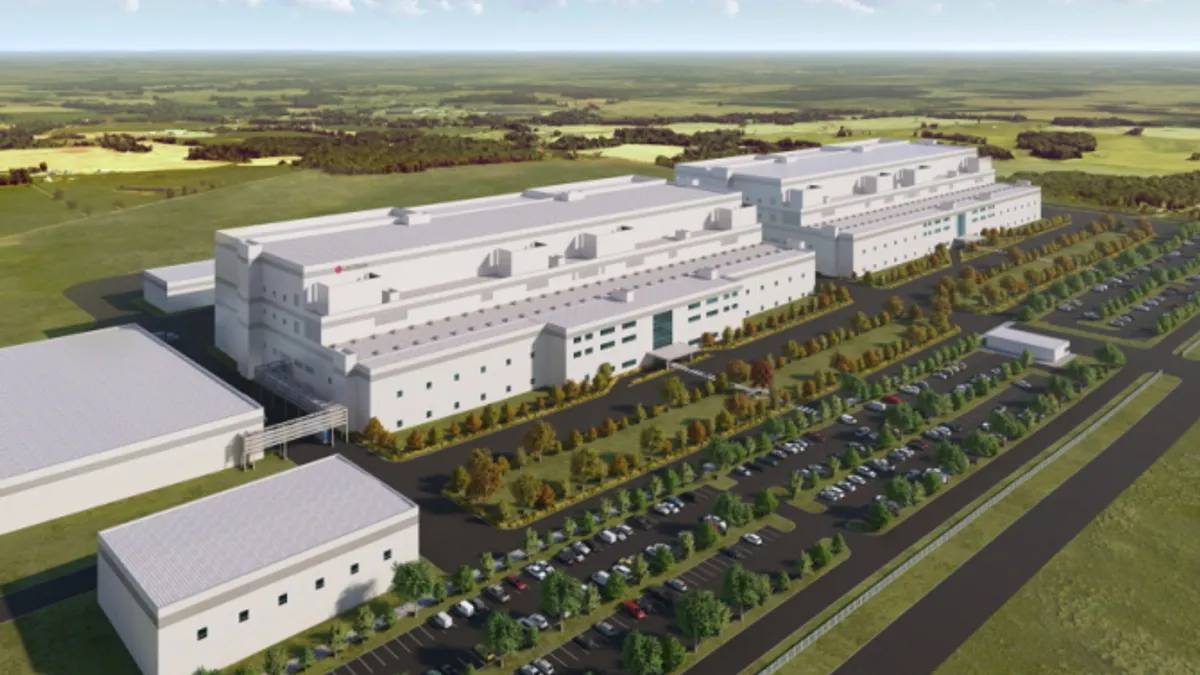

Foreign companies have also sought out the state. South Korea-based LG Chem is building a $3.2 billion cathode manufacturing facility in Clarksville, citing the state’s proximity to key customers and easy transportation of raw materials as draws. The project, which represents the largest foreign direct investment in Tennessee history, also received $40 million in state grant funding.

In August, Australia-based EV charger manufacturer Tritium opened its first U.S. facility in Lebanon, Tennessee.

John Boyd, a principal at the Boyd Company, provided site selection council to Tritium when choosing the Lebanon site. He noted that the state provides an enticing operating environment to companies, with “the best return on investment for manufacturing.

“The state is characterized by low operating costs, low taxes, a number of shovel-ready industrial sites, and a pro-business regulatory environment,” Boyd said.

The growth of the manufacturing industry in Tennessee is apparent. Since the start of the year, Gov. Bill Lee has announced at least $599 million worth of advanced manufacturing investment in the state, in sectors including bottling, food and automotive.

Building a business-focused state climate

One way in which Tennessee has set out to attract investment is through manufacturing-friendly state policies.

The state offers several tax incentives for businesses that relocate or expand in Tennessee, including including job creation and industrial machine installation tax credits. Manufacturing is also one of only five types of companies highlighted by the state as qualifying for the incentives.

Bradley Jackson, president and CEO of the Tennessee Chamber of Commerce & Industry, noted the state’s variety of investment-attracting attributes.

“These initiatives include significant state investments in workforce programs, economic development initiatives, and tax policy that has benefited manufacturers that chose Tennessee for their operations,” Jackson said.

In addition to tax incentives and credits, the state has also invested in building state-wide and regional workforce development programming. This includes “Tennessee Promise,” which offers two years of tuition-free community or technical college to the state’s high school graduates.

At a more local level, the Northeast Tennessee Regional Hub launched in April 2022 to foster collaboration across public and private entities to drive economic development in the area.

“The Department of Economic & Community Development and the Tennessee Valley Authority have been at the forefront, going above and beyond to aid companies with establishing and growing their operations,” said Mitch Miller, COO at the Northeast Tennessee Regional Hub. “Whether it be through basic job incentives or more complex frameworks such as infrastructure support, they both work hard to identify whatever issues need solving and apply creative approaches to succeed in doing so.”

Leaders in the state also say low taxes and other policies are draws for major manufacturing projects.

Tennessee is one of 28 states or territories with a right-to-work law, making it optional for workers to join a union. While critics argue the law weakens unions and shifts power in the favor of large corporations, Shea Hopkins, executive director of the Clarksville-Montgomery County Industrial Development Board highlighted the law as an attraction to businesses.

“Thanks to a well-trained workforce, a welcoming community, a high quality of life, and an excellent business climate, many of our local industries have expanded, with several boasting multiple expansions,” Hopkins said.

Hopkins also cited the state’s lack of personal income tax as another reason why more companies are setting up shop in Tennessee.

“It is no surprise that companies choose Tennessee for our business-friendly environment,” she said. “The state also offers a variety of incentives and grants specifically designed with business in mind.”

Market location and proximity to other businesses

“Because we have so many OEMs in and around Tennessee engaged in diverse industries ranging from automotive to the production of ceramic tile, their suppliers are flocking to the state as well,” said Chris Caputo, leader of Baker Donelson’s Manufacturing Initiative, who worked as an advisor for LG Chem’s investment in Tennessee.

“With every billion-dollar-plus factory project that comes into the state, there may be several eight- to nine-figure projects that will be built by companies that will supply locally-produced goods and materials to the factory.”