Editor’s note: This story is part of an ongoing series diving into the opportunities and challenges facing the manufacturing industry in 2023. Read the rest of the series here.

Many companies are embarking on ambitious construction projects for new manufacturing sites in the year ahead.

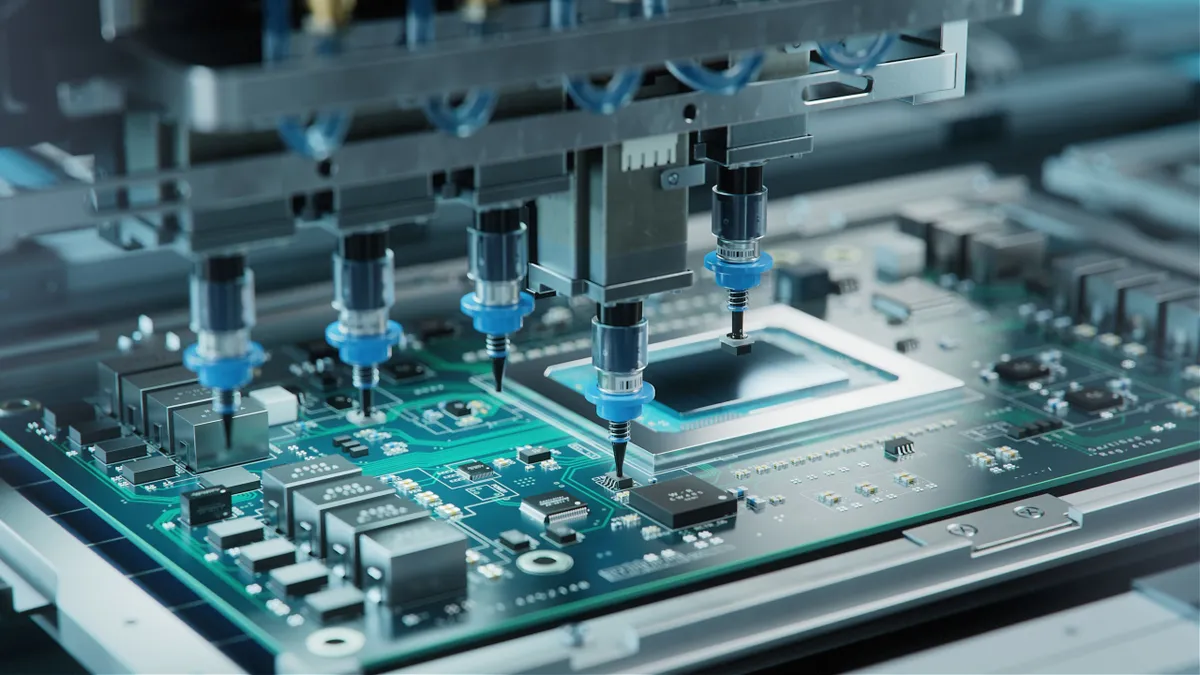

Some, like TSMC’s fabrication plant in Arizona, will produce emerging technologies meant to bolster U.S. supply chains, while others, like Siemens’ electric vehicle charger factory in Texas, will help push the U.S. towards a sustainable future.

The projects vary in size and scope, but each has the potential to make a major impact on the industry and they communities in which they operate.

From semiconductors to solar panel plants, here are seven major U.S. manufacturing projects to watch in 2023.

TSMC

-

Product: Semiconductors

-

Investment: $40 billion

-

Location: Phoenix, Arizona

-

Timeline: The first of two fabrication plants will begin production in 2024, with the second coming online in 2026

In December, Taiwan Semiconductor Manufacturing Company (TSMC) announced plans for a second fabrication plant in Phoenix, Arizona. The two facilities are slated to be among the largest foreign investments in the U.S.

The facilities are expected to create roughly 10,000 high-paying tech jobs, as the U.S. aims to strengthen the domestic semiconductor supply chain.

President Joe Biden visited the site of the plants in December to make a pitch for improving the U.S.’s investment in semiconductor research and production. TSMC is one of several companies taking advantage of new legislation from the Biden administration to incentivize domestic investment in manufacturing, including the CHIPS and Science Act.

Intel

-

Product: Semiconductors

-

Investment: $20 billion

-

Location: Licking County, Ohio

-

Timeline: Construction began in 2022, with production scheduled to begin in 2025

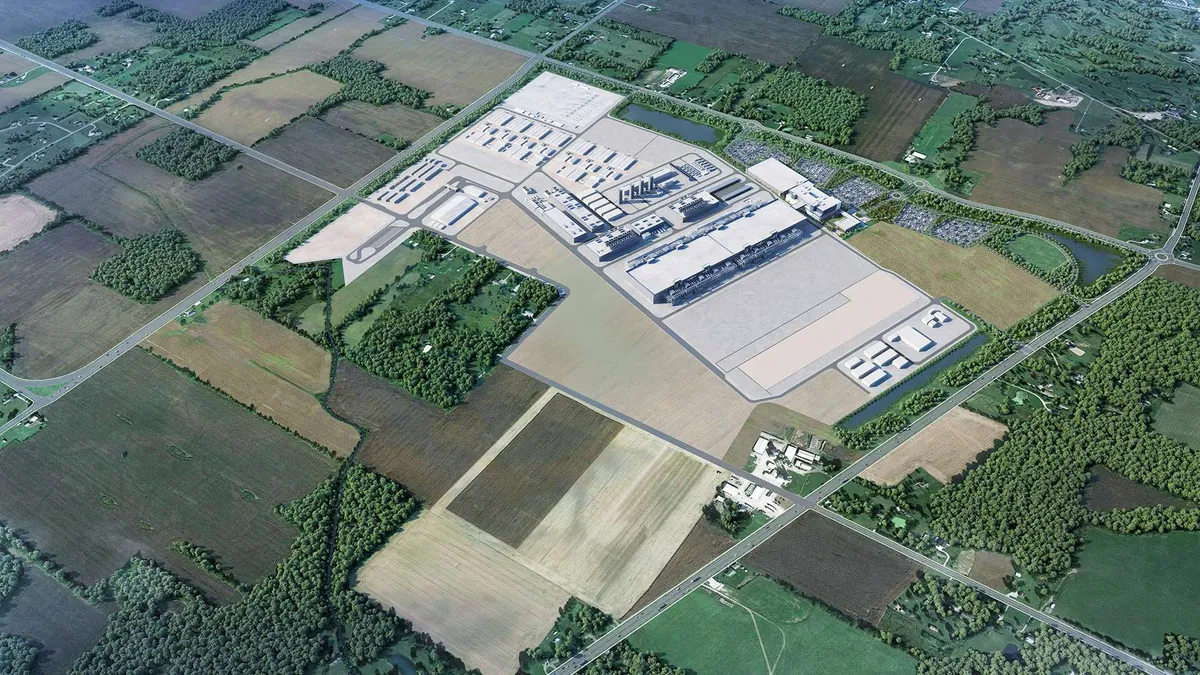

Biden and other officials broke ground on Intel’s massive semiconductor facility in September. The largest private sector investment in Ohio’s history, the initial phase of construction is slated to create 7,000 jobs. The site spans 2.5 million square feet and will include two semiconductor plants.

Samsung

-

Product: Semiconductors

-

Investment: $17 billion

-

Location: Taylor, Texas

-

Timeline: Construction began in 2022, with plans to open in 2024

This is the company’s largest investment in the US, with building now underway for the 5-million-square-meter site. Samsung said in a November 2021 press release that it chose Taylor as the home of the advanced chip facility due to its proximity to the “local semiconductor ecosystem,” as well as to the company’s existing production site in Austin, Texas, allowing the two locations to share infrastructure and resources.

Samsung has spent the past year making construction headway on the project, as well as getting involved in the city of Taylor. In September, the company held a local job fair for positions at the plant, and announced $1 million in charitable donations to local organizations.

Form Energy

-

Product: Iron-air battery systems

-

Investment: $760 million

-

Location: Weirton, West Virginia

-

Timeline: Construction to begin later this year, with production slated to start in 2024

Energy storage company Form Energy partnered with the state of West Virginia to launch its first commercial-scale iron-air battery manufacturing facility. The project is estimated to create about 750 jobs in the community, fueling much-needed economic growth in the region.

The facility will sit on the site of a former steel plant, as the state looks to break into emerging technology manufacturing. The government of West Virginia and its Economic Development Authority offered Form Energy roughly $300 million in financial assistance and incentives to help bring the project to the former steel town.

Abbott

-

Product: Nutritional powder

-

Investment: $536 million

-

Location: Bowling Green, Ohio

-

Timeline: Construction to begin this year, with potential completion by 2026 and commercial production in 2027

Healthcare company Abbott Laboratories is constructing a nutritional powder factory in Northwest Ohio months after its high-profile baby formula production breakdown at a Michigan facility.

The facility will produce specialty and metabolic powder nutritional products, including products for those with extreme food allergies or other dietary conditions. The plant is slated to create 450 permanent jobs, further boosting Ohio’s growing manufacturing capacity.

Siemens

-

Product: EV chargers

-

Investment: Undisclosed

-

Location: Carrollton, Texas

-

Timeline: The site is expected to be fully operational by mid-2023

Germany-based tech company Siemens is opening its second U.S. EV charger plant. The 80,000-square-foot plant is estimated to create about 100 new jobs. The location is a strategic choice as the new plant is surrounded by other facilities belonging to the company, including its EV charging distribution center in Southaven, Mississippi, and its Grand Prairie, Texas, manufacturing hub, which develops equipment for critical power infrastructure.

“In the next decade, the US will need millions of chargers to support the rise in EV adoption,” John DeBoer, head of Siemens eMobility North America, said in a statement. “With this investment, Siemens is continuing to grow our U.S. EV charging manufacturing footprint to help answer this call and continue preparing the nation’s infrastructure as we steadily head to an all-electric future.”

Enel

-

Product: PV solar cells and panels

-

Investment: Undisclosed

-

Location: To be announced

-

Timeline: Construction to start mid-year, with panels available for purchase by the end of 2024

Italy-based energy company Enel announced in October its plans to build a solar photovoltaic (PV) cell and panel manufacturing facility in the U.S. The project, which has yet to have a publicized location, will be one of the first solar cell production facilities in the country and is expected to create about 1,500 new jobs in the next two years.

It will be Enel’s second factory and its first outside of its home country of Italy, as the company looks to take advantage of incentives offered in the Inflation Reduction Act and the growing demand for solar energy.