Irene Signorino is the managing director of advisory and strategy at KPMG U.S. Opinions are the author’s own.

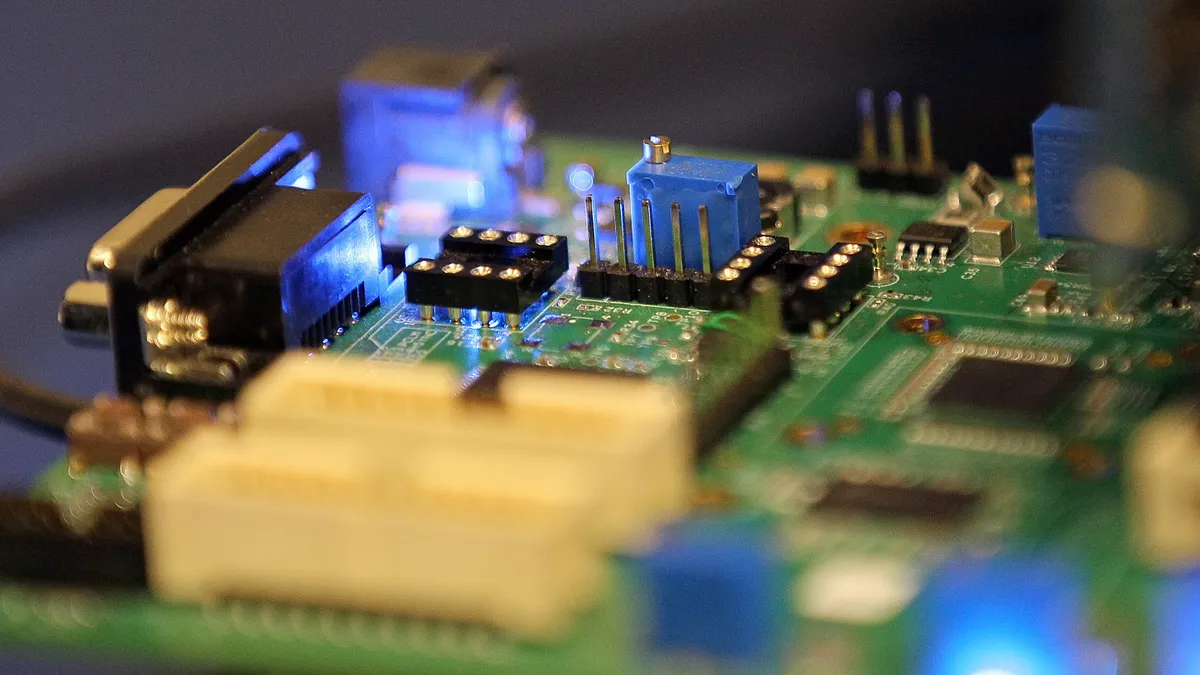

The semiconductor industry is vital to technological innovation, economic growth, national security and global competitiveness, it is also a cyclical industry.

Semiconductor demand has been strong over the last few years and despite challenges like the COVID-19 pandemic, geopolitical tensions and supply shortages, the industry reached a record revenue of roughly $580 billion in 2022, according to the World Semiconductor Trade Statistics. We are now in a downturn as the market weathers softer demand driven by inflation, among other factors.

In past industry downturns, the standard practice has been to hit the brakes — stop hiring, postpone capital investment and cut overhead. This time, special circumstances connected to an industry-wide talent shortage, availability of special government funds and emerging ESG requirements call for a more careful approach.

Here are three areas semiconductor companies can focus on to continue driving growth amid a drop in demand.

Manage headcount costs without jeopardizing future growth

Talent is a critical risk for semiconductor companies and remains a priority for executives, according to KPMG's 2023 global semiconductor outlook.

There are several short-, medium- and long-term approaches to help companies retain and attract key talent even as headcount costs are being controlled. Among the viable approaches, companies can:

- Prioritize non-headcount costs whenever possible

- Develop a long-term staffing model that is in line with the company’s strategic roadmap and use it to guide any short-term headcount decisions

- Balance short-term headcount cost initiatives with career development programs and other incentives to retain critical talent

- Utilize remote work options both as a retention strategy and a real estate cost control strategy. Even before the pandemic, 40% of semiconductor employees had remote or hybrid work arrangements, according to a survey by KPMG and the Global Semiconductor Alliance.

Leverage government initiatives

Semiconductor manufacturers in the U.S. have a unique opportunity to take advantage of federal funds, including the CHIPS and Science Act and other one-time programs such as the Infrastructure Investment and Jobs Act.

Semiconductor industry CapEx investments reached a record amount in 2022, with many companies publicly committed to expanding capacity. But, as demand softened in the second half of the year, several investments were either delayed or canceled. Unfortunately, such actions will jeopardize the ability to take advantage of one-time government incentives and likely hinder companies' ability to meet demand once market growth inevitably restarts.

As outlined in a recent KPMG advisory on CapEx decisions in a downturn, some considerations for semiconductor companies looking to make strategic investment decisions include:

- Consider asset divestiture or other restrictions

- Manage depreciation

- Review existing capital projects for potential leakage or cost recovery

- Consider alliances/partnership structures to reduce risk to your business

Continue ESG investments to prepare for new environmental regulations and laws

Adherence to new ESG guidelines is becoming mandatory for businesses. According to KPMG research, 79% of technology CEOs admit to feeling pressure from employees and customers to constitute green initiatives.

Here are some considerations for semiconductor companies looking to make strategic investments decisions, as outlined in a recent KPMG paper on ESG decisions in a downturn,

- Understand ESG has a material impact on shareholder value creation

- Adhere to Sustainability Accounting Standards Board’s (SASB) recommendations

- Use this economic cycle to get ahead and prepare for more stringent ESG regulations

Identify long-term opportunities

As companies continue to grapple with the recent market slowdown, there are still significant opportunities for growth in the long term. For example, the automotive semiconductor industry’s rapidly growing demand for chips and sensors will likely represent a $250 billion market in 2040, according to KPMG research projections.

It is important for companies to navigate the current downturn without limiting their prospects for future growth. Specifically, there are options to optimally manage headcount costs without jeopardizing future talent, to continue expansion plans by taking advantage of one-time government incentives, and lastly, to invest in ESG in preparation for new environmental regulations and laws.