Since the Department of Labor proposed a new federal threshold for overtime pay of $55,068 last month, companies have begun strategizing around what the change could mean for their employees, and their bottom line.

The proposal is an increase from the current threshold of $35,568, and could make an additional 3.6 million workers in the U.S. eligible for overtime pay.

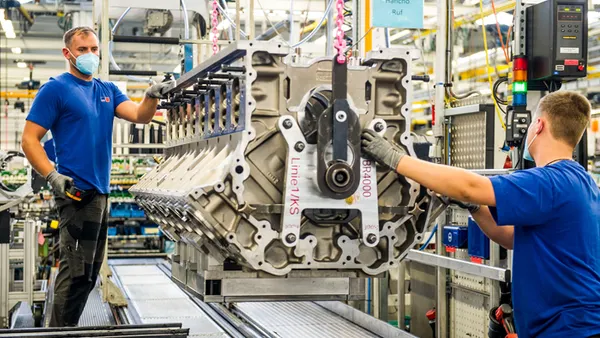

So what does the potential change mean for manufacturers, and what should they know?

To better understand the possible changes, Manufacturing Dive spoke with Neal Shah, a partner at law firm Frost Brown Todd, who focuses on employment law and wage and hour litigation across manufacturing and other sectors.

Uncertainty is likely to continue, but now is the time to prepare

The proposed rule is expected to see challenges in court, just as the Obama administration's overtime proposal was eventually blocked by a federal judge in 2016. Such a likelihood means companies won't definitively know whether they will have to deal with the changes for several weeks or even months.

While the proposal has yet to be approved, now is the time for companies to start preparing in case it does take effect, Shah said.

"It's not going to be a gigantic shift, but it's a significant change," Shah said. "Because I think it's going to affect a lot of folks that are kind of in the lower middle management area and a lot of administrative folks."

The first step when preparing for the rule's possible rollout is to determine which individuals and positions on the workforce will be impacted by the change and by how much.

Many of these workers, Shah said, fall into the category of workers making between the previous threshold of just over $35,000 and under the new threshold of over $55,000. For these employees, executives will need to decide whether to start paying them overtime, or raise their base pay above the new threshold, making them once again exempt from the rule.

"And so for those folks, it's going to be a real question of, ‘OK, hey, how do we treat them? Are they going to be exempt or not exempt?’" he said.

Unprepared companies could face litigation

These decisions will then affect manufacturers' budgets and operational costs, making it imperative to begin taking stock of the number of employees affected now. Otherwise, companies could find themselves under-prepared to take immediate action when the proposal becomes reality, leaving themselves vulnerable to litigation if they aren't in compliance, Shah noted.

"Either the Department Labor comes after them, or more likely it'll be private lawsuits,” Shah said. “And the challenge with these cases is it's usually not one employee that gets affected. And so it becomes class or collective action, which then increases the cost of litigation significantly."

When preparing for the possible rollout of changes to employees' pay or overtime status, Shah noted team morale is a key component. Some workers may be wary of being moved to an hourly pay or of variations in exempt status among employees.

“People will look at it sometimes as a demotion — if I was a salaried employee and now I’m becoming an hourly employee — [so] you’ve got to be clear in your communications that that’s not the case, you still have the same job, you still have the same authority,” he said.

Smaller manufacturers in particular should start preparing for the possible change, Shah said, noting that the rule could impact a larger percentage of their total workforce and require more advanced planning from a leaner HR staff.

There are several resources manufacturers can use to help with this planning, including from the Society for Human Resource Management, as well as contacting their general counsel, internal HR team and possible external consults.

Shah recommended that companies identify who in their workforce could impacted by the proposal and to sketch out some options by the end of 2023. "Ultimately, what you really want to do is, by the time it's implemented, at least have a sense of what you're likely to do and how you're going to effectively roll that out,” he said.