Dive Brief:

- The CHIPS and Science Act’s manufacturing incentives should be extended beyond 2026 and expanded to include chip design if the country is to support the continued domestic growth of the sector, the Semiconductor Industry Association stated in its 2024 state of the industry report.

- The report noted the U.S. should prioritize workforce development for roles such as engineers to address a possible 67,000-worker labor gap by 2030.

- The group also plugged its support for the Semiconductor Technology Advancement and Research Act, or STAR Act, which would expand the CHIPS Act’s 25% investment tax credit to include investments in semiconductor design. The research and development House of Representatives legislation, introduced on July 30, is led by Rep. Blake Moore and seven other lawmakers.

Dive Insight:

SIA’s recommendation to extend the CHIPS Act tax incentives past 2026 comes as the law proves to be driving the U.S.’s growing share of the global advanced chip manufacturing market.

The report highlighted that the CHIPS legislation will grow the U.S.’s share of advanced chip manufacturing to 28% of global capacity by 2032.

The report also predicts the U.S. will capture 28% of total global capital expenditures from now until 2032. By comparison, in the absence of the CHIPS Act, the report estimates the U.S. would have captured only 9% of global capex in that time.

To achieve those milestones, however, SIA notes the country must focus on semiconductor design. Currently, U.S. companies account for half of global chip design revenue, according to SIA. Global competitors like India and South Korea are challenging that edge however, as they prioritize chip design in their own national semiconductor plans.

“The U.S. has built-in advantages in chip design, including being home to the world’s best universities and a highly skilled workforce,” SIA stated in a July 30 press release. “Global competition in chip design is increasing, however, as other countries actively support the development of their own design sectors.”

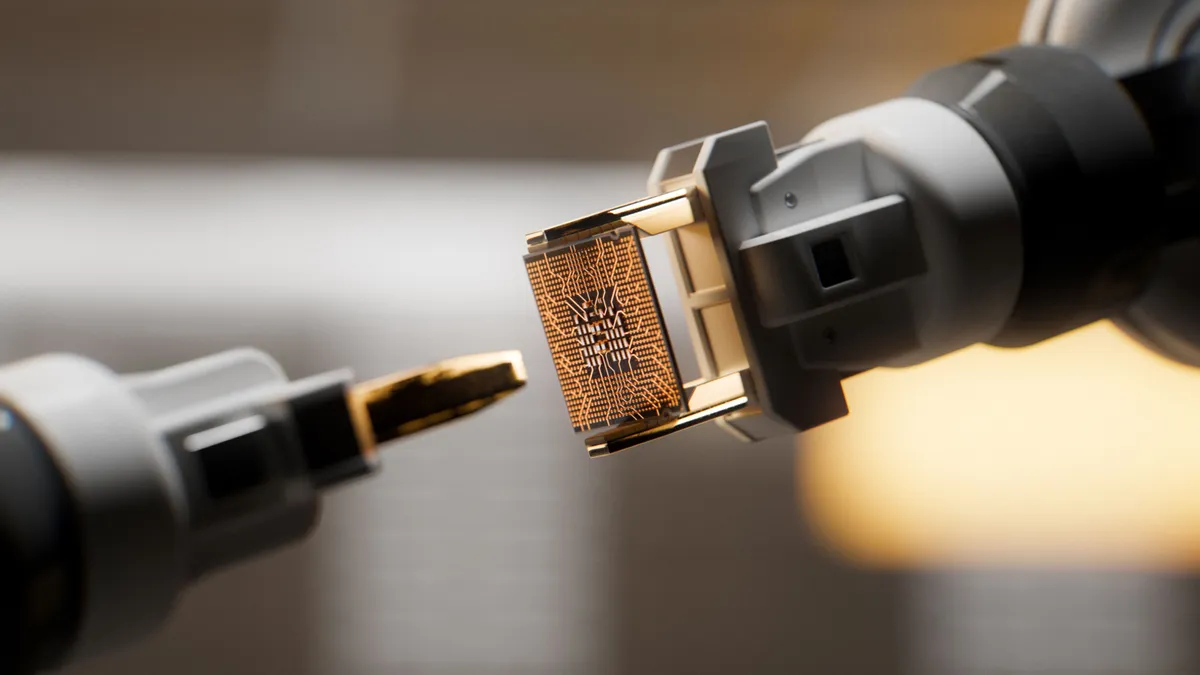

In the decade following the 2022 passage of the CHIPS Act, the U.S. is projected to increase its fab capacity by 203% — the highest rate of growth in the world during that period — according to a May 2024 SIA-Boston Consulting Group report. In design, there is a growing need for specialty chips, such as AI accelerators, to accommodate the proliferation of new devices and associated functions.

“Meeting this demand opens the door to new vendors in different regions, including new markets — India, for example, is home to an estimated 20% of all design engineers,” the SIA-Boston Consulting Group report stated.

Another aspect of that growth is the use of artificial intelligence, which is acting as both an enabler for production and as a demand driver in the sector.

"AI is dramatically enhancing electronic design automation (EDA) software,” the state of the industry report stated. “And for fabs, which produce extraordinary volumes of data continuously, AI drives faster determination of root cause for failure modes, streamlines quality assurance measures and efficiency for wafer processing, and optimizes factory operations.”