Boeing had a tumultuous 2024.

Since a door plug blew out midair on an Alaska Airlines 737-9 Max in January 2024, the airplane titan’s manufacturing and safety systems have faced scrutiny by both regulators and consumers, who claim the incident was the result of a pattern of production shortcuts that allegedly favored speed over quality.

The incident magnified issues in Boeing’s processes, leading the Federal Aviation Administration to cap the company's commercial aircraft production at 38 planes a month.

As a result, Boeing submitted a safety improvement plan to the FAA in May 2024 with a proposal to address its systemic quality control and safety issues, which includes six key performance indicators focused on four areas: elevating safety and quality culture, investing in workforce training, simplifying manufacturing processes and plans and eliminating defects.

Fast forward to 2025, and Boeing is off to a good start, making progress with its goal to meet the KPIs and ramp up production of 38 planes a month and possibly more later in the year.

Boeing is also making progress in other priority areas in its culture and development programs, President and CEO Kelly Ortberg said at a Barclays Industrial Select Conference in February. Ortberg succeeded Dave Calhoun as CEO in August 2024.

“I certainly want this to be a much more stable year for the company,” Ortberg said at the conference last month. “A lot of work to do, but I think where we are today is we’re turning into 2025. I feel like we’re headed in the right direction.”

As of Feb. 28, Boeing's deliveries of its commercial aircraft totaled 89, an approximately 65% year-over-year jump, according to its website.

Deliveries have also outpaced 2023’s numbers by nearly 35%, which saw 66 deliveries.

“You know, 2025 in some ways could look like 2023, maybe a bit better if things go our way,” CFO and EVP of Finance Brian West said on an earnings call in January.

While experts say Boeing is on the right path to bring back more production, in-house work culture challenges and an uncertain geopolitical climate could interfere with the company's momentum.

Beyond the KPIs

Boeing began 2025 by progressively ramping up production, West told analysts in January.

Still, the production rate and deliveries aren’t a direct correlation, Ortberg said last month. A 53-day workers' strike caused a work stoppage last year, costing the company between $50 million and $150 million a day, according to aerospace consulting firm Leeham News and Analysis.

“I think one thing to remember is that the airplanes that we are delivering today were airplanes that had work in process prior to the strike,” Ortberg said. “So that’s why we had really strong January deliveries.”

Nevertheless, Ortberg is focused on the KPIs to help Boeing improve and ramp up production.

“And one of the things that I’m trying to do is be very careful when I ask how we’re doing,” Ortberg said at the conference. “I don’t ask the question of how many do we deliver, how many are we going to deliver, however our KPIs look. Because I do believe the KPIs are what’s key to allow us to unleash the production ramp up.”

Jerrold Lundquist, managing director at aerospace and defense consulting firm The Lundquist Group, said Boeing’s January performance is encouraging.

“I'm cautiously optimistic that [KPI] approach is doing well, and that the expectation is that they'll ramp up slowly to 38 by mid-year, probably late mid-year,” Lundquist said. “And then when they've gotten to that level, then moving up to say, 42, is not as great a leap. The hope is that they could get to 42 in the latter half of ‘25.”

Bill Remy, CEO of supply chain firm TBM Consulting, said the KPIs are promising because they focused on the issues Boeing had.

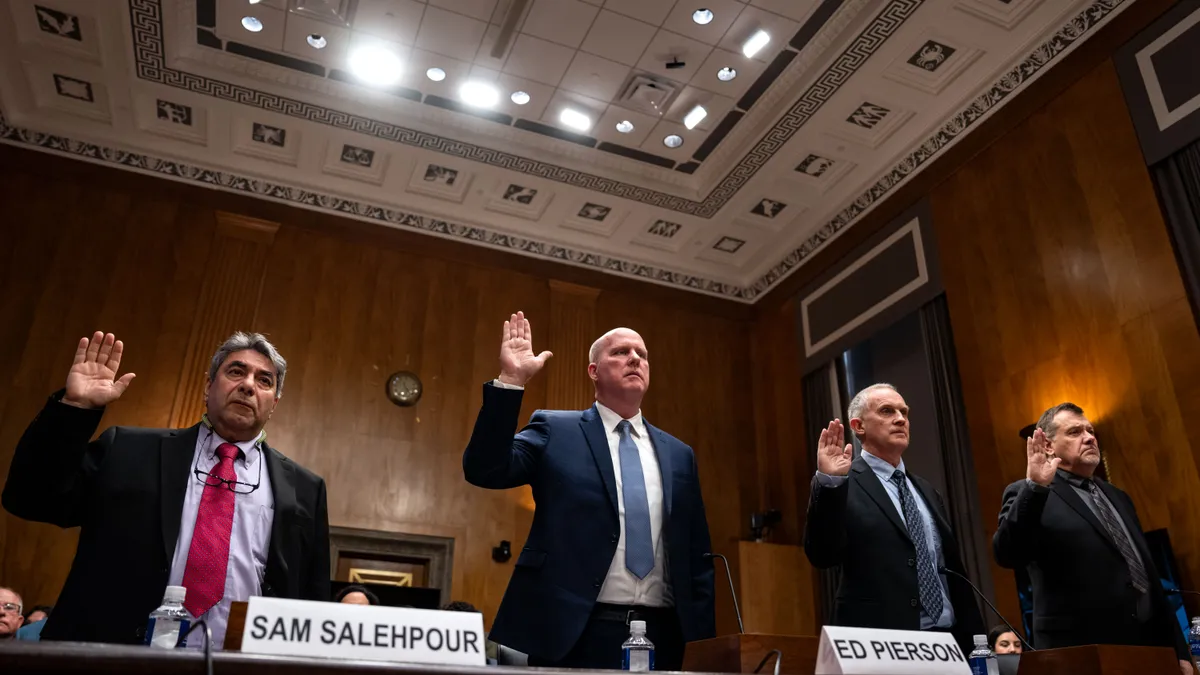

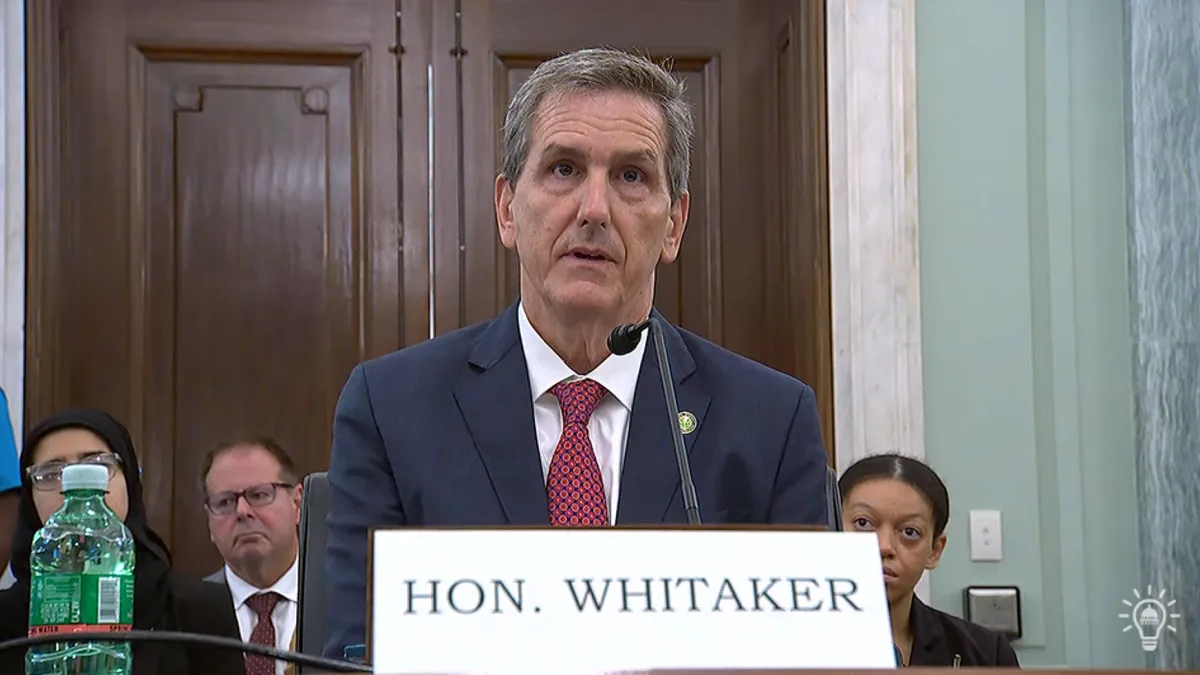

But Ortberg’s mention of the company culture goes beyond the KPIs and will be a challenge because it involves a vast number of people, which will take a while, Remy added. An FAA audit, as well as National Transportation Safety Board hearings and federal whistleblower hearings, unveiled a disconnect between Boeing employees and senior management regarding the company’s safety culture.

If Boeing can prove to regulators it's made tangible progress in its manufacturing processes, it could help the company get approval to raise its production rates, Remy said.

“It's going to be a long haul,” Remy said. “There's no quick fixes here. There's no magic pills. It's going to be a long, slow grind.”

Tariffs could impact supply chain

The U.S.’s 25% tariffs on Mexico and Canada-made steel and aluminum went into effect March 12. President Donald Trump also hiked China levies up to 20% earlier this month and on Sunday said there would be no exemptions, CNN reported.

Canada retaliated by imposing 25% tariffs against the U.S. that began the following day.

Tariffs could bring another unforeseen issue to Boeing and other U.S. aircraft manufacturers, as aluminum is a material overwhelmingly used by the industry, according to the Aluminum Association.

Globally, Boeing has more than 560 suppliers in Canada, according to a company handout. Metal suppliers include Pyrotek Aerospace and Asco Aerospace, according to the Aerospace Industries Association of Canada.

Boeing also has over 35 direct suppliers in China, with the country being its number one international customer in its commercial segment, according to another handout.

Mexico is one of Boeing’s top 10 global regions for sourcing plane components and assemblies, according to another handout. The plane maker and its suppliers spend about $1 billion a year toward the country’s aviation manufacturing industry

While Ortberg and the company have not publicly commented on the tariffs, Boeing did note the levies in their Q4 2024 securities filing, saying it could adversely affect their operations in the future, particularly in China.

When Trump last imposed China tariffs, Boeing utilized the U.S. Border and Customs Border Protection’s duty drawbacks for refunds, according to the securities filing.

“The problem is that if [tariffs] are imposed in the short term, there's not a lot you can do,” Lundquist said. “The supply chain is fairly rigid for good reason, and it's difficult to move it on short notice.”

Lundquist also added that switching suppliers could introduce tremendous risk.

“Boeing has, up until now, has been reluctant to shift production from one supplier to another,” Lundquist said. “If a supplier is falling down, they try to give support to that supplier.”

The tariffs are going to be a problem, Remy said, as components are needed to complete the product. It could also create even more expenses for Boeing after 2024 financially drained the company. Boeing spent billions of dollars to fix its production woes, as well as millions of dollars in cash advances to supplier Spirit AeroSystems to keep its operations afloat.

In the meantime, Boeing said in its securities filing that it’s monitoring the global trade environment and will work to mitigate potential impacts. Though, Remy said he thinks Ortberg should remain focused on quality improvements, rather than get distracted by geopolitical volatility.

“Just demonstrating that they can run their process and do it for quality and repeatably and reliably to generate good quality aircraft going out the door, because if they can't demonstrate that, and can't ramp back up, the cost is largely not as important, because they will not grow the business,” Remy said.