Battery manufacturing investments are booming in the U.S.

From Arizona to Ohio and South Carolina, some of the industry's biggest players are investing in multi-billion-dollar battery factories to produce cutting-edge electric vehicle batteries.

As manufacturers and automakers hope to jump-start widespread EV adoption in the months ahead, many are pushing to make new breakthroughs in battery technology to lower their price and increase their driving range.

One of the key ways companies are hoping to make these changes in the sector is by examining emerging battery technologies that offer alternatives to the typical nickel manganese cobalt mix.

Automakers, battery manufacturers and a host of startups are exploring how to improve and increase production of battery forms like lithium iron phosphate, solid-state and sodium-ion. Some, like LFP, have started hitting the commercial market with major manufacturing plans, while others are still in the developmental stage.

The months ahead could be a critical time for many of these companies to reach new technological breakthroughs in battery manufacturing. Read on for some of the top trends to watch in this space in 2024.

The rise of LFP batteries

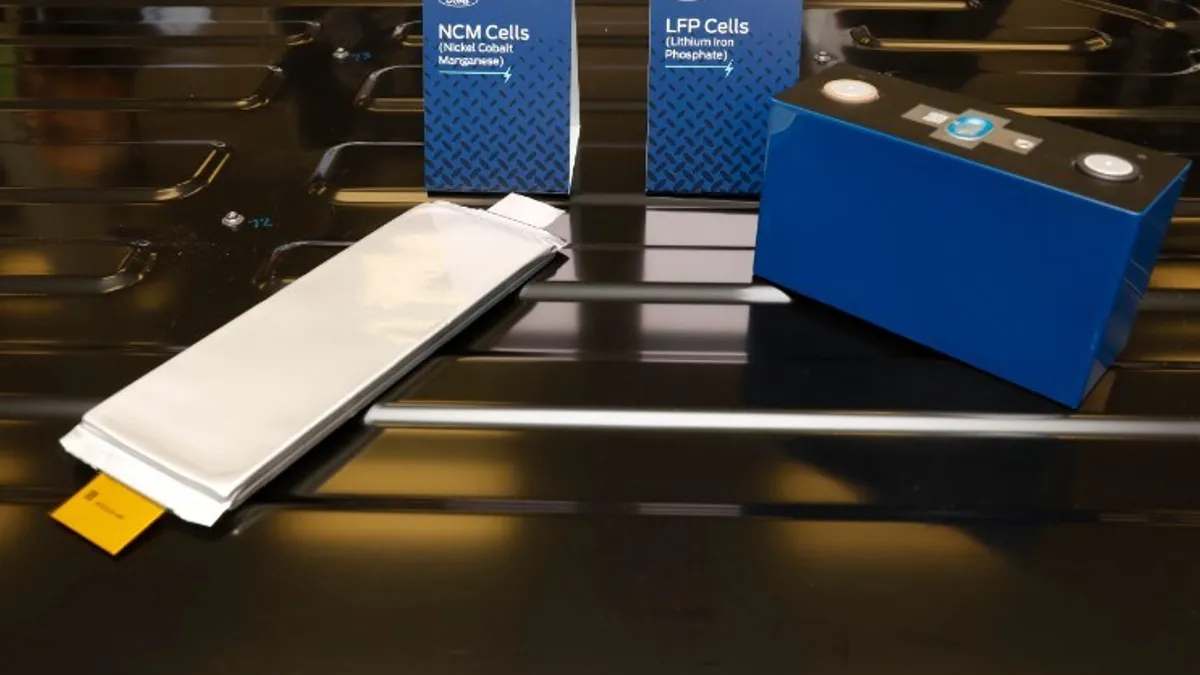

The EV industry is largely divided between two types of lithium-ion batteries: nickel manganese cobalt batteries and lithium iron phosphate. The two forms of battery chemistries offer different advantages to EVs – LFP batteries are known for their lower price point, safety and longevity, while NMCs offer higher energy density, making them more compact and powerful, able to drive longer ranges before needing a charge.

Thus far, the U.S. EV industry has been largely dominated by NMCs given their greater energy capacity and driving range. General Motors' Ultium batteries are NMC-powered, as are many of the EVs currently on the market from Hyundai and Ford.

Preferences are shifting, however, as companies look to push down EV price points, rev up adoption and lessen reliance on China for supply of critical minerals like cobalt and nickel.

Ford announced plans last February to build its first LFP battery plant in Marshall, Michigan. And in September, Cummins, Daimler and Paccar unveiled plans to build a joint $3 billion LFP battery factory.

While in past years LFP batteries were often overlooked due to their technical limitations, as new forms of cylindrical cells and pouch cells hit the market, the chemistry combo is becoming more enticing, said Don Wright, VP of engineering at Unico, an EV testing provider.

"The biggest trend I think we're going to continue to see is this trend moving from NMC batteries to LFP," Wright said. "What [automakers are] finding out is the general public really wants to have a lower cost, reasonable electric vehicle and have it be safe, and in order to do that, you don't need that super high performance. The LFP chemistry is the right configurations and provides enough battery power."

Solid-state batteries are gaining traction, but manufacturing needs advancements

Solid-state batteries are emerging as a possible future option for EVs. Unlike lithium-ion batteries, which use liquid electrolyte solutions in their cathode, anode, separator and electrolyte concoction, solid-state batteries use solid electrolytes.

The alternative battery form promises a higher energy density than its lithium-ion counterparts while also being smaller and lighter. In addition, they could be safer to produce and use, with less chance of igniting, a drawback to lithium-based batteries that automakers like Ford have had to contend with.

Solid-state batteries for EV use are still in development and have yet to hit the commercial market. This year, however, could see new breakthroughs in the science behind the batteries, said Varnika Agarwal, a research analyst at Rho Motion.

The batteries won't be ready for commercial use in 2024, but Agarwal said she believes that could happen by the end of the decade.

"Most probably in 2030, we'll start seeing a bit more of solid state coming into batteries," she said. "It's still, I would say, interesting to track, but still far from commercialization."

One advancement in solid-state battery manufacturing that could expedite their development is improvements in manufacturing plants’ dry rooms. Dry rooms are carefully controlled, low dew point spaces that allow for safe and stable manufacturing for products like EVs.

Greater advancements in battery manufacturing technology require increasingly lower moisture levels, ultimately requiring the removal of humans and the humidity they produce, said Jay Sayre, Director of Innovation at Ohio State University's Institute for Materials Research. As more of the processes behind this tech become automated, those dry room enhancements could be possible at larger scales, he said.

"We've got to be able to have more automation, more robotics, assembly of the cells without the human involved," Sayre said.

Sodium-ion offers a lithium-free alternative

A third battery form gaining traction in the industry this year is sodium-ion. The battery, which replaces lithium with sodium, could be a low-cost, fast-charging alternative, but has yet to achieve higher energy density.

By some estimates, sodium-ion batteries were achieving a similar level of energy density in 2022 as low-end lithium-ion batteries were a decade ago.

Automakers are taking note of sodium-ion's possibilities. Earlier this month, Stellantis announced it was investing in France-based sodium-ion battery startup Tiamat.

While the technology is still under development, Agarwal said it's a space she's watching carefully this year. She noted that in December, Chinese state-backed JAC Group debuted its first sodium-ion battery-powered EV for commercial sale, a major breakthrough in the space. The car's batteries are produced by state-backed battery maker HiNa Battery.

"It's interesting to see all these developments in the sodium-ion space," Agarwal said. "It's quite tempting to see these products getting to the commercialization phase.